The UK’s ICF (International Climate Finance) — a portfolio of projects from DFID (Department for International Development), BEIS (Department for Business, Energy and Industrial Strategy), and Defra (Department for Environment, Food and Rural Affairs) — makes catalytic investments to support developing countries to respond to the challenges and opportunities of climate change through projects in deforestation, resilience-building, clean energy and more.

Many of these are ‘demonstration projects’, which prove to other investors that low carbon projects can be scaled up or replicated with little or no finance from donors. This happens when evidence from the original project shows that similar investments can be financially attractive, impactful and worth the risk. For example, an ICF-funded renewable energy project that successfully demonstrates both sustainable development impacts and a return on investment could encourage other investors to do something similar.

Itad has been helping the UK government to better understand these dynamics. Our evaluation of ICF, which used demonstration effects as its guiding concept1, looked at how ICF mobilised private finance into low carbon, climate-resilient markets.

Building confidence

Our portfolio evaluation identified £350 million of private finance that had been mobilised into 21 projects through demonstration effects2. This means £350 million of investment that can be linked back to evidence from an ICF-funded project having reached and influenced the investor.

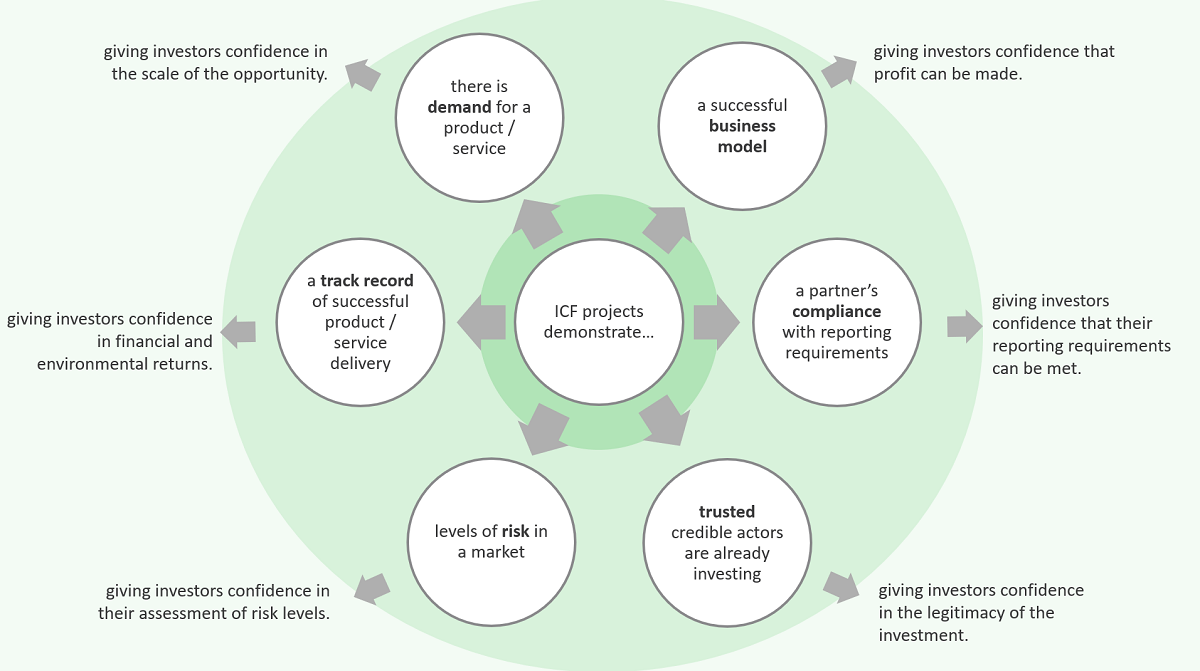

How do these effects work? There are different ways to give investors the confidence they need to make the decision to invest in low-carbon, climate-resilient markets. We identified six types of demonstration effects, that is, six ways in which a programme can show potential investors that investments in low carbon markets are a viable option for them. The graphic below illustrates how demonstrating six main factors — demand, business model, compliance, trust, risk, and track record — can give private investors the confidence they need to begin investing in low-carbon, climate-resilient markets.

Effects on different investor types

Whether or not these six demonstration effects work to catalyse a new, green investment depends on who is receiving them. Most importantly, we found that they work differently for four main investor types:

- Businesses and developers (such as solar system companies): if demand for their products and services is uncertain and/or something about the business model for satisfying that demand is uncertain, demonstration effects encourage businesses and developers to pursue opportunities because they give them confidence that their business can succeed and will be able to secure investment.

- Direct investors ( those seeking to provide debt or equity directly to businesses or projects): when they do not have enough information to assess an investment opportunity then demonstration effects provide them with confidence in the likely returns, enabling them to assess the risk associated with the investment more accurately.

- Fund managers (those who offer funds which invest in projects or businesses, into which others invest): when they have no experience of managing funds that invest in climate change projects, demonstration effects provide confidence that the model is viable as they will be able to secure funding and find suitable opportunities for investment.

- Institutional investors (those who invest into funds which in turn invest in projects or businesses such as pension funds and insurance companies): when they have a mandate for sustainable investment but do not have experience of investing in particular climate change funds, evidence from demonstration projects provides them with confidence in fund managers’ abilities to secure investment, find opportunities and deliver acceptable returns.

Example: How demonstration effects mobilised private investment in a solar home system supplier

ICF’s REACT (Renewable Energy and Adapting to Climate Technologies) programme supported a solar home system supplier in Kenya to develop their business. With the evidence generated from this programme, the company was able to raise a further $10 million USD from an equity investor to finance further growth. The investor explained that receiving REACT investment gave the company confidence in the investment opportunity:

“It improved our confidence and trust in the company as they had support from DFID because we know that they’ve done due diligence and we know that they have some sort of level of credibility.”

REACT had helped the investee company to demonstrate that their business model was sound and that they could generate cashflow which gave them the confidence to expand their business and take on the commitments of additional investment.

Why context matters

Demonstration effects can produce significant multiplier effects for climate finance mobilisation which should not be taken for granted. But there is no one-size-fits-all approach to ensuring an intervention or investment creates them. The contexts within which investments are made must be understood. Is the market a new one? Has demand not yet been proven? Is there insufficient publicly available market information? Only when the circumstances and the ‘demonstrations’ are right for an investor, will they lead to increased investment in low-carbon markets.

Our report provides a number of insights to help understand these dynamics, which the UK government is using to refine and centralise its approach to mobilising private finance through demonstration effects. Now that we have a better understanding of what works and for whom, other donors can also become more effective in accelerating the take-up of low-carbon technologies worldwide.

For more detail on how, for whom, and in what circumstances ICF projects work to mobilise additional private finance into low-carbon markets, read the full report.